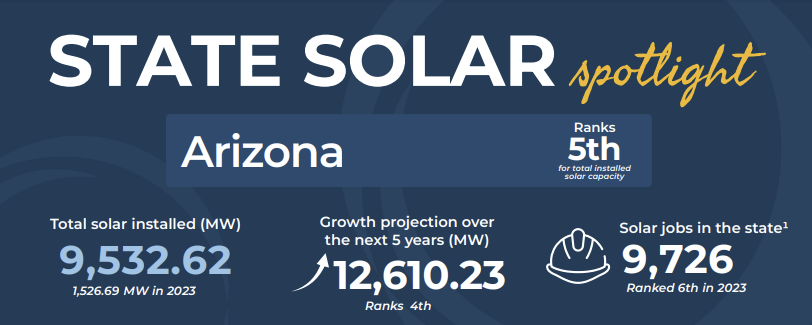

Arizona is the sunniest state in the US, with major cities in and around the Phoenix Valley experiencing over 300 sunny days yearly. With such an amazing solar resource, it’s only natural that Arizona is one of the best states for solar, ranking fifth in total installed capacity.

As of August 2024, the average utility rate in Arizona was 14.85 cents/kWh, having increased almost 25% over the last 10 years. Despite the available solar resources and more than 170 operating installers, SEIA describes the Arizona solar market as somewhat turbulent due to declining NEM policies and eliminating incentives, among other things.

While electric rates are below the national average, many Arizona utilities have peak demand pricing structures. The extreme heat means homes use a large amount of electricity, so solar can be incredibly beneficial.

Below, we’ll describe some incentives and programs available to Arizona residents, and you can find a full list at https://programs.dsireusa.org/system/program/az/solar

Table of Contents

Federal Incentives

Federal Investment Tax Credit (ITC)

Residential solar systems installed in Arizona are eligible for the Federal ITC, which provides up to 30% credit toward the total cost of a solar system. The Inflation Reduction Act (IRA) of 2022 extended the 30% credit through 2032. Starting in 2033, the ITC value will drop to 26%, followed by a drop to 22% in 2034.

The credit is non-refundable, meaning it cannot exceed the amount you owe in tax and would not directly increase any refund you would receive. Excess credit can be carried forward and used in future years.

The IRA also included standalone or retrofitted energy storage projects, so batteries added to the system’s quality for the 30% tax credit.

Modified Accelerated Cost Recovery System (MACRS)

IRS section 179 depreciation allows certain qualified properties to be classified as 5-year properties and tax credits are taken on the depreciation. This credit applies to commercial sites and certain investment properties. Specific information on what qualifies can be found on the IRS website.

State Incentives & Programs

Residential Solar and Wind Energy Systems Tax Credit

Homeowners installing passive solar, solar hot water, solar space heating, solar pool heating, and solar PV can file for a one-time credit toward their state income taxes. The credit amounts to 25% of the cost of the installed system, with a maximum credit of $1,000 per residence, regardless of the number of devices installed.

Sales Tax Exemption

Solar energy system equipment is exempt from Arizona sales tax, which is 5.6%. This exemption factors into the upfront price homeowners see, so prices can be lower than in other areas. Batteries are not included in the exemption, and some cities have their own sales tax, which would still apply.

Property Tax Exemption

Property tax assessment considers solar energy systems to add no value to a property, thus not increasing property taxes when one is installed. Homes with solar typically sell for 5-10% more than comparable homes without solar, so the property tax exemption can save some money over the long term.

Sunwatts Renewable Energy and Rebate Program

Residents who receive service from Mohave Electric Co-Op, which serves about 38,000 customers in western Arizona, can receive $0.05/W for installed solar PV up to $2,500. Leased systems are not eligible for this incentive so the homeowner must own the system. For a customer installing a 10 kW system, this incentive would pay them a one-time rebate of $500.

Mohave also offers a residential and commercial battery storage rebate to support people who install batteries. Members can receive $500 when they install a battery with a warranty of at least 10 years or 5000 cycles, a 5 kilowatt-hour (kWh) minimum usable capacity, programmable controls, Wi-Fi connection, and not charge during off-peak hours.

Net Metering

In December 2016, the Arizona Corporation Commission voted to replace net metering with “net billing,” which still gives homeowners credit for excess generation sent back to the grid but not at a full retail rate. Essentially, net billing is like NEM 2.0, which California implemented between 2017 and 2023, and we are seeing it in many places across the country right now.

As of August 2024, Arizona’s average retail electric rate was $0.1485/kWh. Here are the current net billing rates for the investor-owned utilities:

- Arizona Public Service (APS) – $0.06857 / kWh

- Tucson Electric Power (TEP) – $0.0570 / kWh

- Unisource Energy Services – $0.0680 / kWh

There are 16 electric utilities in Arizona serving various areas, and each has its own unique net billing or net metering rate. Some, like Salt River Project (SRP), give credit much lower than the retail rate but have time-of-use plans that allow customers to get more for their exported energy. For specific information on what’s available to you, talk with your trusted solar provider or contact your local electric utility.

Solar in Arizona

With only a few incentives available to Arizona residents the main push for homeowners to invest in solar lies in the large amounts of energy use needed to fight extreme heat. Utility rates have increased more than 25% over the last ten years but solar prices have also fallen 37% over that same period of time. Given high energy needs and increasing electric rates, Arizona will continue to be atop the US solar market for the foreseeable future.

Always talk with your local solar installer and trusted tax professional for information specific to your situation and how tax incentives can benefit you.