The recent looming economic pressures, especially proposed tariffs on imported solar components, create potential turbulence for overseas manufacturers and the domestic companies that rely on their goods.

These pressures heighten the risk of default, leaving solar homeowners vulnerable if their system components fail and the manufacturer is no longer around to honor the warranty.

At Solar Insure, we recognize these potential risks and, through our future-proof warranty solutions, have safeguards in place to protect homeowners from the long-term impacts of manufacturer instability.

Table of Contents

The Current Landscape: Tariffs Tighten Margins

Proposed tariffs on solar panels and components from countries like China, Cambodia, Malaysia, Thailand, and Vietnam, which currently supply 80% of U.S. solar panels, are poised to reshape the industry.

These tariffs could significantly increase equipment costs and squeeze manufacturers’ profit margins if enacted. One North American manufacturer, Heliene, reported facing monthly losses of $3 to $4 million due to retroactive tariffs on imports from Laos.

These financial headwinds aren’t isolated incidents; they’re warning signs. Companies with slim margins and high overhead are likelier to exit the market or default on warranty obligations, leaving customers without protection.

Potential Impact

In order to analyze the potential impact of these new tariffs, we need to look at the impact of past tariffs. Back in November, we published an article and video discussing solar’s history with tariffs and how new tariffs will affect the industry.

In 2018, tariffs were put on solar cells and panels at a 30% rate, which was set to decrease by 5% per year for 4 years. The first 2.5 gigawatts of modules were exempted from the tariff, then the 30% kicked in. This tariff was extended in 2022 at a 15% rate, but with the first 5 gigawatts exempted.

The US International Trade Commission found that rather than decreasing the amount of imported panels, imports of cells and modules increased between 2018 and 2019.

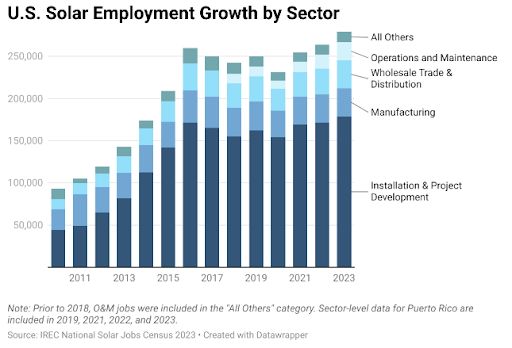

The Solar Foundation’s National Solar Jobs Census, published in November 2018, found that the solar industry employed over 242,000 workers, a decrease of 3.2% (8,000 jobs) from 2017. The decrease is cited in part due to uncertainty over the outcome of the tariffs.

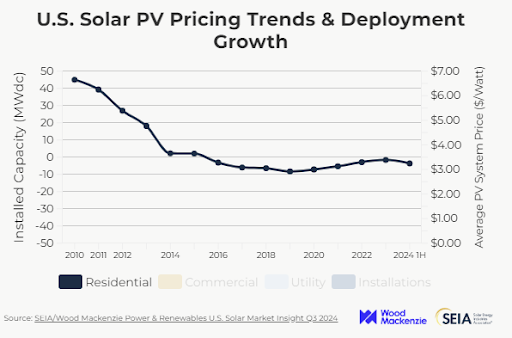

As for end-user prices, there has been a noticeable upward trend since 2019. Historically, solar prices have sharply declined as installed capacity continues to grow. However, since 2017, prices have flattened out and increased. 2017 SEIA and Wood Mackenzie found the average residential PV system price to be $3.08/W. The average price in the first half of 2024 was $3.25/W.

Given what happened with tariffs in the past, we can predict that the potential impact of tariffs will be in a few key areas:

- Hardware price increases: New tariffs are across the board on all imports, so expect all pieces of a solar system to get more costly. Panels, inverters, batteries, racking, etc. If any piece is imported, the price will likely increase.

- Supply chain disruptions: These disruptions could be caused by equipment being held up or delayed due to higher demand for domestic goods.

- Installer pressure: Smaller margins mean a higher risk of contractor insolvency. After the 2018 tariffs, we saw a short-term job dip, but the industry recovered quickly.

What Happens When a Solar Panel Manufacturer Fails?

When a solar manufacturer files for bankruptcy, it liquidates assets and ceases operations, typically voiding warranties and leaving homeowners without manufacturer support for repairs or replacements.

While your solar panels may continue generating electricity, any future malfunctions and component failures could result in out-of-pocket expenses, especially for “abandoned” systems (systems where the installer is also out of business) with limited access to compatible parts or a service provider.

Those homeowners with loans remain obligated to pay the loans despite losing production and warranty coverage, as seen in cases like SunPower’s 2024 collapse, where customers were left with unsupported systems.

However, there are mitigation options homeowners can explore to lessen the impact of insolvencies. In many cases, solar systems are made up of components from several different manufacturers. If an installer becomes insolvent, homeowners can still check with the manufacturer and ensure the components’ warranty is valid. Solar homeowners can seek a service provider to repair their system in this case.

Major Solar Panel Manufacturer Bankruptcies

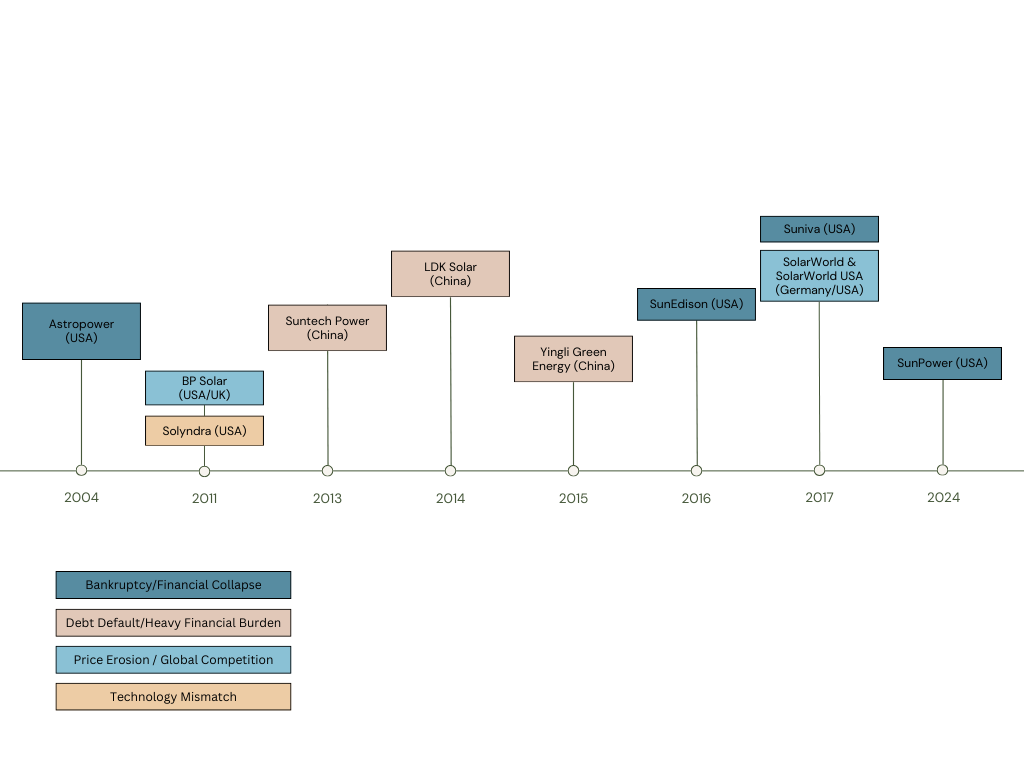

Unfortunately, several high-profile manufacturer bankruptcies have occurred in the past few years due to solar market turbulence, changing policies, and supply chain disruptions.

- AstroPower (USA) 2004: Once a leading U.S. solar cell maker and a top-ten PV producer in the early 2000s, AstroPower filed for Chapter 11 bankruptcy in 2004.

- BP Solar (UK/USA) 2011 (Closure): British Petroleum’s solar subsidiary shut down in late 2011. BP Solar cited “growing commoditization” and an inability to profit as panel prices dropped.

- Solyndra (USA) 2011: Solyndra was a California-based startup manufacturing cylindrical CIGS thin-film panels. Backed by a $535 million U.S. DOE loan guarantee, it failed in September 2011 when it could no longer compete with dropping silicon PV prices.

- Suntech Power 2013: Suntech was the world’s largest PV module producer in 2011. In March 2013, Suntech Power’s main subsidiary in China (Wuxi Suntech) was forced into insolvency after the company defaulted on a $541 million bond payment

- LDK Solar (China) 2014: LDK was a Chinese silicon wafer giant that expanded aggressively upstream (into polysilicon) during the boom. It became burdened with over $1 billion in debt and couldn’t repay bonds due in 2014.

- Yingli Green Energy 2015–2017 (Default/Restructuring): Yingli was another Chinese heavyweight. By 2015, however, years of razor-thin margins left Yingli deeply in debt, about $1.9 billion. The company defaulted on bond payments in 2016, missing a RMB 1.76 billion ($270M) loan payment in May 2016.

- SunEdison (USA) 2016: SunEdison’s implosion was one of the largest in clean energy history. Initially a silicon supplier (MEMC) turned global developer, SunEdison went on an acquisition-fueled expansion spree from 2014 to 2015 before failing in 2016.

- Suniva – 2017: Suniva was one of the few remaining U.S. crystalline-silicon cell manufacturers by mid-2010s, headquartered in Georgia (majority-owned by China’s Shunfeng). It filed for Chapter 11 bankruptcy in April 2017, citing mounting losses due to “rising imports” of low-cost solar cells that took away its market share.

- SolarWorld & Solar World USA – 2017-2019: SolarWorld was a major German-based module manufacturer (with factories in Germany and Oregon, USA). It led the fight for solar trade tariffs against Chinese dumping earlier in the decade, but by 2017, SolarWorld succumbed to the same pressure. In May 2017, SolarWorld AG filed for insolvency, stating that “ongoing price erosion” left it with no viable business path and heavy debt.

- SunPower – 2024 – SunPower is one of the world’s oldest and largest solar companies, founded in 1985. It produced solar panels and white-labeled micro inverters. On August 5, 2024, SunPower filed for Chapter 11 bankruptcy protection. The company has sold its assets to Complete Solaria for $50 million.

A History of Protecting Homeowners

SolarWorld USA, a major U.S. solar panel manufacturer based in Hillsboro, Oregon, faced financial turmoil that culminated in its parent company, SolarWorld AG, declaring insolvency, followed by SolarWorld Americas filing for Chapter 11 bankruptcy.

This left thousands of American homeowners with SolarWorld panels losing warranty coverage for their solar systems, which typically carried 25-year warranties against defects and performance degradation. The bankruptcy threatened to orphan systems, potentially costing homeowners thousands for replacements or repairs, as warranties are often unsecured liabilities in bankruptcy proceedings, leaving little recourse. Before this uncertainty, Solar Insure stepped in with a pivotal solution, agreeing to back warranties for certain SolarWorld panels, ensuring continued protection for affected homeowners.

Solar Insure’s intervention was a lifesaver for those with SolarWorld systems. By providing its warranty program to cover eligible panels, Solar Insure bridged the gap left by the bankruptcy. This provided peace of mind, guaranteeing coverage for parts and labor, key concerns for residential solar owners.

Unlike standard manufacturer warranties, which often exclude labor or become void in insolvency, Solar Insure’s program, backed by an A.M. Best A+-rated insurer, offered robust, transferable protection tied to the home’s address.

For homeowners who invested $15,000–$25,000 in solar, their systems remained viable, preserving the value of their clean energy investment. To this day, nearly a decade after SolarWorld’s collapse, Solar Insure continues to honor its commitment to these homeowners.

This support highlights Solar Insure’s role in stabilizing the residential solar market during turbulent times. Solar Insure safeguarded individual investments and bolstered trust in solar adoption by protecting homeowners from the fallout of SolarWorld’s bankruptcy, proving that reliable warranties can weather even the most brutal industry storms.

Solar Insure’s Manufacturer Default Coverage

Our SI-30 Warranties include manufacturer default protection backed by an A.M. Best A+-rated insurance carrier. If your equipment fails and the manufacturer is no longer in business, we ensure your coverage remains intact. This protection spans solar panels, inverters, and batteries for up to 30 years.

This is more than just a promise, it’s a proven process:

- Fast Claims Turnaround: Most claims are processed in 7 to 10 business days.

- Zero Deductibles: No surprise costs to homeowners.

- Certified Installers: We handle claims directly with vetted professionals.

- Product Replacement: We cover labor and product replacement, restoring system performance.

SolarDetect for Homeowners

SolarDetect, by SolarInsure, is available in California, Florida, Texas, New Mexico, Utah, Nevada, and Arizona. It supports homeowners with systems from bankrupt installers. It provides proactive monitoring to detect performance issues and offers warranty coverage for systems that are not already malfunctioning.

SolarDetect provides professional monitoring, service, and support for qualifying systems, ensuring prompt repairs through verified contractors. Homeowners pay a monthly fee for this safety net service.

Built on a Strong Foundation

We don’t just react to manufacturer risk—we proactively monitor it.

Our rigorous 7-Step Manufacturer Evaluation Process assesses financial health, product performance, and claims history before a component is included in our warranty. We also continuously monitor system performance through our proprietary platform, Daybreak, which helps us identify potential failure trends early.

You can read more about our actuarial-backed warranty structure and conservative reserve strategy in our 30-Year Warranty Foundation article.

The Need for Industry-Wide Vigilance

In light of proposed tariffs and shifting economic realities, the risk of manufacturer default will likely continue to rise. Homeowners and solar providers must proactively choose coverage beyond the manufacturer’s promises.

With Solar Insure, you’re not just buying peace of mind—you’re investing in a system backed by financial stability, data-driven insights, and 30 years of protection regardless of market conditions.

Have questions or want to learn more about how Solar Insure protects against manufacturer risk?

Visit solarinsure.com or connect with our team to discuss your needs.