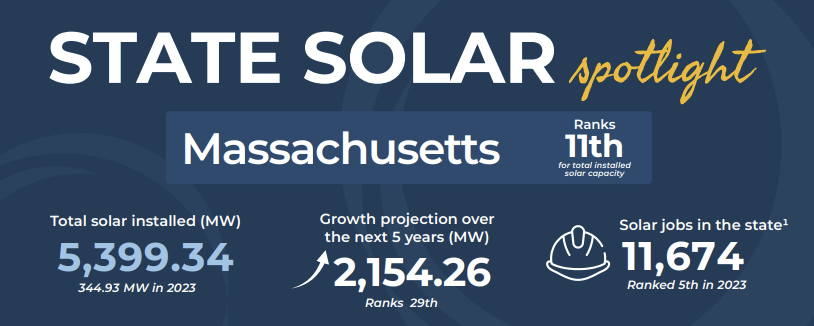

Massachusetts ranks 11th in the country in terms of installed solar capacity as of 2024. The state has nearly 5,400 MW of installed solar capacity, and the solar industry is worth over 12 billion dollars. According to SEIA, the state gets just over 25% of its electricity from solar energy, and that number will only continue to increase with the state’s Renewable Portfolio Standard.

As of August 2024, Massachusetts’ average residential electric rate was 29.42 cents/kWh. It boasted the second largest overall percentage increase in electric rate over the last 10 years, 69%, second only to California. On average, the yearly utility rate escalation is 5.58% per year, nearly double the national average.

Between high electric rates and a state that has committed to renewable energy, homeowners going solar in Massachusetts can see massive savings. In addition to savings, prospective solar buyers have a few incentives available.

A complete list of available incentives and programs can be found at: https://programs.dsireusa.org/system/program/ma/solar

Table of Contents

Federal Incentives

Federal Investment Tax Credit (ITC)

Residential solar systems installed in Massachusetts are eligible for the Federal ITC, which provides up to 30% credit toward the total cost of a solar system. The Inflation Reduction Act (IRA) of 2022 extended the 30% credit through 2032. Starting in 2033, the ITC value will drop to 26%, followed by a drop to 22% in 2034.

The credit is non-refundable, meaning it cannot exceed the amount you owe in tax and would not directly increase any refund you would receive. Excess credit can be carried forward and used in future years.

The IRA also included standalone or retrofitted energy storage projects, so batteries added to the system’s quality for the 30% tax credit.

Modified Accelerated Cost Recovery System (MACRS)

IRS section 179 depreciation allows specific qualified properties to be classified as 5-year properties, and tax credits are taken on the depreciation. This credit applies to commercial sites and certain investment properties. Specific information on what qualifies can be found on the IRS website.

State Incentives & Programs

Sales Tax Exemption

Equipment directly related to solar is exempt from state sales tax so long as the system is used as a primary or auxiliary power system for the taxpayer’s principal residence. Massachusetts has a 6.25% sales tax, so homeowners purchasing a solar system can expect slightly lower prices. The exemption did not initially include batteries but was amended to include energy storage in 2021.

Property Tax Exemption

A property tax exemption is available for solar heating or energy systems as long as the equipment supplies heat or energy. 100% of the solar system’s value is exempt from property tax, meaning installing a system on a home and increasing its value does not impact property tax assessment. It is important to note that this exemption only lasts 20 years.

Residential Energy Tax Credit

Massachusetts homeowners can receive a credit against state income taxes when purchasing a solar or wind energy system. The credit equals 15% of the total system cost, less any federal government credits, grants, or rebates, up to $1,000.

The tax credit is based on the net expenditure, so if a system costs $30,000 and a 30% federal tax credit ($9,000) is taken, the net expenditure is $21,000. 15% of that net expenditure is $3,150, but the limit is $1,000. So, for most solar customers, this credit is a $1,000 state tax credit.

Solar Massachusetts Renewable Target (SMART) Program

The SMART program is a declining block program that pays solar homeowners based on the amount of energy they generate throughout the year. Customers who apply and are accepted into the SMART program receive monthly payments for 10 years at a rate set by their electric utility provider. Since this is a block program, only a certain amount of resources are allocated for the program, and each time a milestone is hit, the incentive level decreases.

Currently, only two utility areas can receive funding: Eversource – Eastern Mass and National Grid – Nantucket.

Source: mass.gov

Systems under 25 kW can receive SMART incentive payments and net metering from their utility. Here’s a sample calculation for a system that produced 400 kWh in a month in Nantucket:

$0.01381 * 400kWh = $5.524

The program also includes adders for systems that include energy storage. The value received depends on the size of the battery system and how much power it can discharge. The state has a calculator homeowners can use to determine the exact amount they are eligible for.

Local Utility Incentives

Massachusetts has three main electric utility companies: Eversource, National Grid, and Unitil. In addition to those utilities, individual towns can set up their own Municipal Light Plants (MLPs) to power their communities. Currently, 41 communities have their own MLPs. Some of those MLPs offer incentives to homeowners who go solar.

- Concord Municipal Light Plant: offers $625 per kW DC up to $3,125 per service address

- Reading Municipal Light Department: offers $600 per kW DC for residential and commercial systems up to 20 kW in size with a max incentive of $12,000.

- Hudson Light & Power: offers $1.20 per installed Watt DC ($1,200/kW) up to $7,500 or 50% of the total project cost.

- Wakefield Municipal Gas & Light Department: residential systems up to 10 kW and commercial systems up to 25 kW can receive $0.80/W ($800/kW) of installed solar that faces between 90° and 270°

- Town of Ipswich Electric Light Department: gives $0.30/W ($300/kW) up to $3,000 for systems 25kW max that faces between 90° and 270°

- Hingham Municipal Lighting Plant offers $0.60/W ($600/kW) for systems up to 10 kW-AC, with a max incentive of $6,000. This incentive is based on kW-AC rather than DC.

Mass Save Connected Solutions

The Connected Solutions program is a virtual power plant program that pays homeowners who enroll their batteries $275/kW for their average contribution during summer events. Participants who enroll in this program and have an eligible battery allow their Mass Save Sponsor to draw energy from their battery no more than 60 times per summer for 3 hours between 3 p.m. and 8 p.m. Summer events occur on non-holidays between June 1st and September 30th.

Net Metering

Legislation in Massachusetts requires investor-owned utilities (Eversource, National Grid, Unitil) to offer net metering for solar homeowners. The utility sets the net metering rate, which is slightly less than the retail electric rate. Credits may be carried over month-to-month indefinitely.

Solar In Massachusetts

Between high electrical rates, net metering, and many local incentives, homeowners investing in solar energy in Massachusetts can see immense savings and reduced upfront costs. A successor to the SMART program is currently being developed, so once that program returns to full force, we expect to see even more solar deployment. For more information on incentives and those specific to you, speak with a trusted solar provider in your area.