New Jersey has been a steady mainstay in the solar marketplace for some time now. Its residential sector has grown steadily over the last ten years, and it is one of a handful of states offering a Solar Renewable Energy Credit incentive.

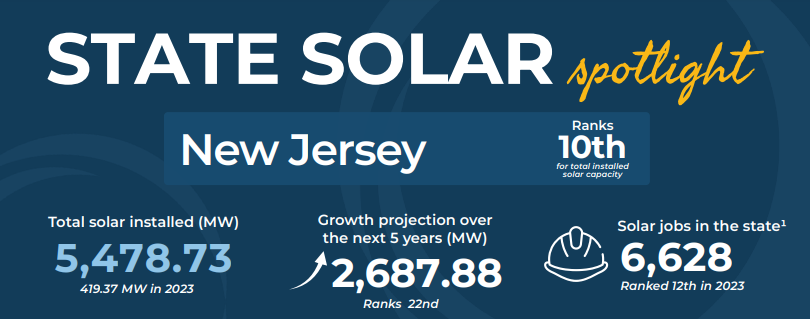

As of Q3 2024, New Jersey ranks 10th in the country in installed solar, up from 18th at the end of 2023. With a total installed capacity of 5,478 MW powering almost 8% of the state’s electric needs, New Jersey is quickly making a strong name for itself in the solar space.

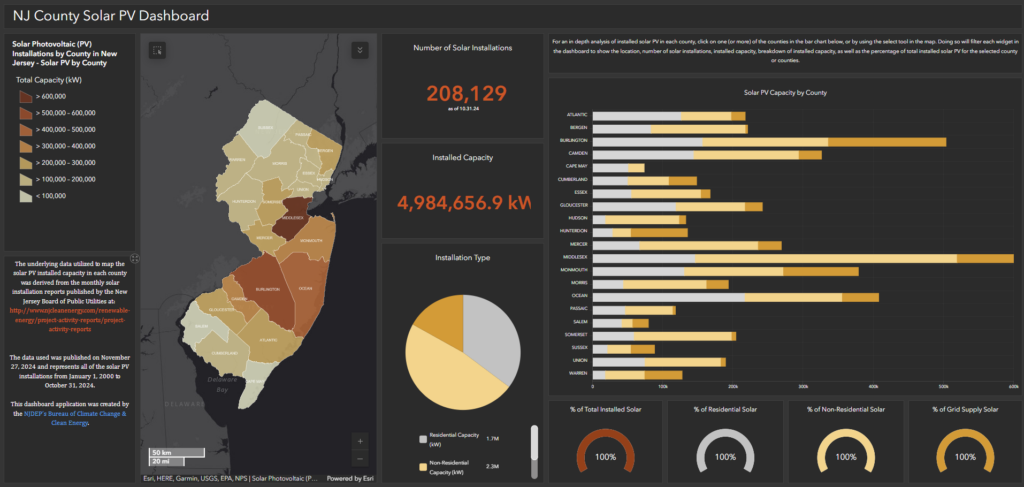

The New Jersey Department of Environmental Protection created a unique dashboard anyone can visit to see current stats on the New Jersey Solar Industry:

Below is a list of incentives available to solar owners in New Jersey. More information can be found at https://programs.dsireusa.org/system/program/nj or by talking with your solar provider.

Table of Contents

Federal Incentives

Federal Investment Tax Credit (ITC)

Residential solar systems installed in New Jersey are eligible for the Federal ITC, which provides up to 30% credit toward the system’s total cost. The Inflation Reduction Act (IRA) of 2022 extended the 30% credit through 2032. Starting in 2033, the ITC value will drop to 26% followed by a drop to 22% in 2034.

The credit is non-refundable meaning it cannot exceed the amount you owe in tax and would not directly increase any refund you would receive. Excess credit can be carried forward and used in future years.

The IRA also included standalone or retrofitted energy storage projects, so batteries added to the system’s quality for the 30% tax credit.

Modified Accelerated Cost Recovery System (MACRS)

IRS section 179 depreciation allows certain qualified properties to be classified as 5-year properties and tax credits are taken on the depreciation. This credit applies to commercial sites and certain investment properties. Specific information on what qualifies can be found on the IRS website.

State Incentives & Programs

Sales Tax Exemption

The state offers a full exemption from state sales tax on all solar energy equipment, including active and passive solar technologies. The exemption also applies to batteries that store solar-generated energy. This program helps reduce upfront costs by removing the state’s 7% sales tax.

Property Tax Exemption

Solar arrays add value to homes and this property tax exemption allows that value to be omitted for property tax assessments. By applying for a certificate from the local assessor’s office, the home’s assessed value is reduced to what it would be without the qualifying renewable energy system.

Successor Solar Incentive Program (SuSI)

The SuSI program was created as the successor to New Jersey’s Solar Renewable Energy Credit (SREC) Program which ended in 2020. The previous program allowed homeowners to trade SRECs on an open market similar to stock trading.

SuSI has two sub-programs, the Administratively Determined Incentive Program (ADI) and the Competitive Solar Incentive Program. The competitive program is for commercial and utility-scale installations over 5 MW.

Under the ADI, a homeowner can receive recurring payments for SRECs produced by their solar panels over 15 years. One SREC is generated for every 1,000 kWh (1 MWh) of energy the solar panels produce. For program years 2024-2025, SRECs can be sold for $85 each. Payments are made monthly or quarterly rather than in lump sum.

Net Metering

All four of the large utilities in New Jersey credit excess generation from solar systems at full retail rates. As of August 2024, the average electric rate in New Jersey was $0.2067/kWh. This is a tremendous benefit to the consumer as they can fully utilize their energy regardless of their consumption. Unsurprisingly, states with retail rate net metering have relatively low battery storage usage rates.

A power true-up is done on an annual basis so excess generation can be used month to month. If a home has leftover excess generation at the end of that annual period, meaning its solar system produced more than 100% of its annual consumption, it is credited back to the owner at the wholesale rate.

Exact rates vary by utility and can change if a home is subject to time-of-use pricing. Check with your local utility for details specific to you.

- Atlantic City Electric (ACE)

- Jersey City Power & Light (JCP&L)

- Public Service Electric & Gas Co. (PSG&E)

- Rockland Electric

Solar in New Jersey

With full retail rate net metering and an SREC program, New Jersey solar homeowners have a top-tier incentive market. The state’s solar industry will only continue to grow, especially with the proposed upcoming Community Solar and Solar For All programs on the way. For more information specific to your situation and home consult your solar provider.