Since the election, tariffs have been the talk of the country, with many industries bracing for potential new tariffs on imported goods. The general populace is concerned about tariffs’ impact, most notably an increase in consumer prices.

But what effect will any new tariffs have on the industry? To predict the future, we need to look at the past. When Solar Insure examined the effects of tariffs on homeowners in 2022, the landscape was different—but much has changed since then.

Table of Contents

What Is A Tariff?

Per Investopedia, a tariff is “a tax imposed by one country on the goods and services imported from another country to influence it, raise revenues, or protect competitive advantages.”

Investopedia also notes that tariffs restrict imports and raise the price of goods and services purchased from another country to make domestically produced goods more attractive. Tariffs are designed to affect the exporting country because consumers in the importing country may shy away from the now higher-priced imported goods. However, if consumers still choose the imported goods, the tariff has essentially raised the cost to the consumer.

Governments impose tariffs to raise revenues and protect domestic industries, consumers, and national interests. Tariffs come in many shapes and sizes, including:

Specific Tariffs: fixed fees based on the type of item i.e. $500 on a car

Ad-Valorem Tariffs: fees based on the value of an item, i.e. 5% of the import’s value

Revenue Tariffs: not designed to restrict imports but to raise revenues

Tariff Rate Quota: a system with variable tariff rates once a certain amount of product imports has been reached.

While there are many positive impacts of tariffs, Investopedia notes there are often unintended side effects, including:

- Make domestic industries less efficient and innovative by reducing competition

- Hurt domestic consumers by pushing up prices

- Generate tensions by favoring specific industries or geographic regions over others

- Create trade wars between countries

Solar’s History with Tariffs

Tariffs aren’t new to solar and for a long time, there has been a push to have more domestically made solar equipment. With the cheaper labor and raw materials in other countries, China and Southeast Asian countries dominated the manufacturing market. American-made equipment existed but came at a premium that the solar industry’s “race to the bottom” mentality couldn’t support.

In order to predict how any new tariffs imposed by the second Trump administration may play out, let’s look at what tariffs already exist and what their impact was on the industry.

In January 2018, President Trump signed a proclamation that put tariffs on solar cells and panels using section 201 of the US Trade Act of 1974. The tariffs were set to begin in February of 2018 at 30%, decreasing by 5% each year for 4 years. 2.5 gigawatts of modules were exempted from any tariffs as were imports from countries the US government deemed “GSP-Eligible” developing nations. In 2018, the US total installed solar capacity was 10.7 gigawatts.

At the time these were instituted, many in the industry fought against them. SEIA (Solar Energy Industry Association) said in their article explaining the tariffs that they would be damaging to the industry because the timeline required to open US-based manufacturing would be too great for companies to adapt before the tariffs had expired. SEIA warned that the US will continue to import 80%-90% of its solar modules and the tariffs would only lead to increased end-user costs and canceled projects.

Before looking at some data and analyzing the effect of the 2018 Trump tariffs, it’s important to note that the solar tariffs were extended by President Biden in 2022. The extension would impose between 14%-15% tariffs on imported crystalline silicon solar products and double the amount of equipment that could come in duty-free and excluded bifacial panels. President Biden also began talks to allow duty-free imports from Canada and Mexico.

Impact of the 2018 Solar Tariffs

In early 2020, the US International Trade Commission (US ITC) published a study investigating the impact of the Section 201 tariffs. In this 500-page study, the commission details that imports of PV cells and modules increased from 2018 to 2019 after the measures were put in place. Prices for PV products continued with their historical downward trend, but the US ITC notes that prices were higher than they would have been without the safeguard measures.

The study also noted that domestic cell production capacity and production decreased from the first half of 2018 to the first half of 2019 as some of the major US PV cell producers ceased production. Multiple module producers opened facilities in the US in the first half of 2019, leading to increased domestic module production.

To simplify the jargon, the tariffs had the opposite effect on imports as numbers increased. Several PV cell manufacturers in the US closed but module production facilities opened.

This means that PV cells would still be made overseas and then imported and assembled into modules in the US. With the ad-valorem tariffs imposing a percentage of the value of the products, it was cheaper to import low-cost raw materials and assemble them in the US compared to importing higher-cost completed modules.

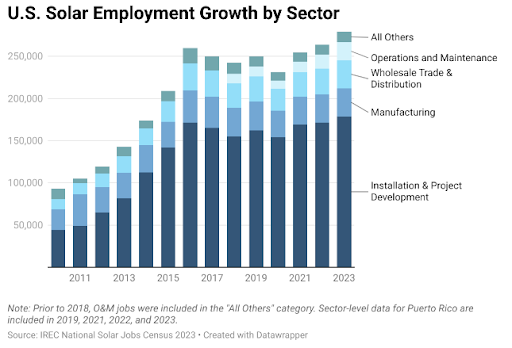

In 2018, SEIA published a study estimating 62,000 lost or never-created jobs in the solar industry and $19 billion in lost investments. Given the perspective of time, what happened, and where are we now?

According to The Solar Foundation’s National Solar Jobs Census published in November of 2018 found that the solar industry employed over 242,000 workers, a decrease of 3.2% (8,000 jobs) from 2017. They cite the decrease in part due to uncertainty over the outcome of the tariffs.

Where Are We Now?

The Solar Foundation’s 2023 Census found that solar employs almost 280,000 people in the US. 100,814 of those jobs were in residential solar and Operations and Maintenance jobs saw a 28% increase.

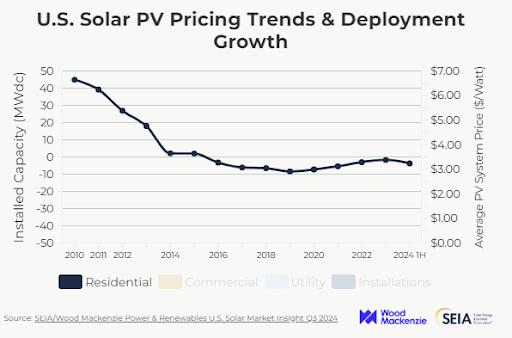

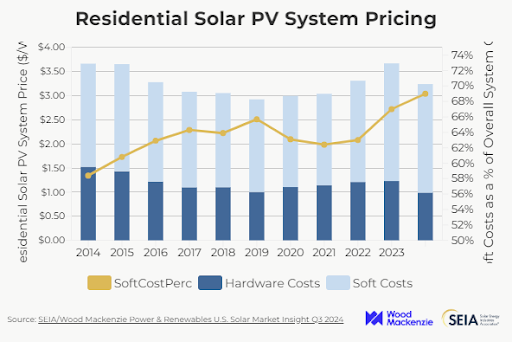

As for end-user system pricing, there has been a noticeable upward trend since 2018.

Studies compiled by SEIA and Wood Mackenzie as of Q3 2024 show a flattening out of the residential pricing for systems. The source lists all the data points, here’s the relevant info:

Average Residential PV System Price ($/Watt)

- 2017 – 3.08

- 2018 – 3.05

- 2019 – 2.92

- 2020 – 3.00

- 2021 – 3.13

- 2022 – 3.30

- 2023 – 3.39

- 1st Half 2024 – 3.25

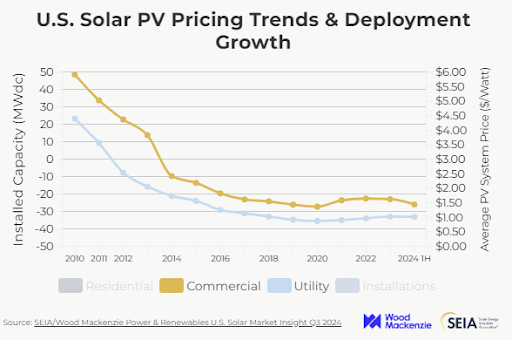

Commercial and Utility scale projects have also seen a flattening of the cost reduction curves since 2018:

The SEIA study indicates that while increased hardware costs account for a portion of the overall cost increases, soft costs such as permitting also remain high. In this chart, you can see that cost costs account for between 50%-70% of the overall system cost.

Interestingly on the topic of pricing, there is some disagreement on US average pricing. As shown above, SEIA found the US average residential pricing in 2024 to be $3.25/W. According to EnergySage though, they found the average cost per watt quoted on their marketplace to be $2.75/W.

In summary, after the 2018 tariffs were put in place there was a slight decline of jobs in the immediate term but the industry adapted and has continued to grow despite extended tariffs. Prices for end users in all sectors have increased, showing that consumers ultimately pay the price for tariffs on imported goods.

However, there has been significant development on the US manufacturing front with many firms opening up manufacturing here in the US. The Department of Energy maintains a list of all domestic solar manufacturing that includes major names like Canadian Solar, Qcells, Silfab, Enphase, and SolarEdge.

Proposed New Tariffs and Their Impact

President-elect Trump has promised to impose multiple new tariffs once his administration takes over in 2025. These include a 10%-20% tariff on all imports, a 60% tariff on Chinese imports, and a 25%-100% import on Mexican imports.

According to the US Department of Energy, in the first half of 2024, the US installed 15.6 Gigawatts of solar. Over that same period, the US has imported about 33 Gigawatts of modules and 3 Gigawatts of solar cells.

Knowing what we know about how the market reacted to the 2018 tariffs and how much solar equipment is still being imported, we can draw some predictions about how 2025 tariffs could play out.

In the short term – the industry may see a dip in total jobs, and the pricing of systems will likely increase across the board. Importantly, the previous tariffs were specifically on solar modules and cells. The proposed tariffs would affect all imports so smaller components previously not taxed could now see increased costs.

In the long term – solar has shown itself to be a resilient industry that can face many challenges and still makes sense for consumers. The studies conducted have shown that long term the solar industry will continue to break records for installation capacity and job growth. Price reductions may flatten out, but continued development of the US-based solar market will provide additional duty-free capacity and may help to bring down costs and add to domestic job growth.